New Business and Natural Capital Accounting Case Studies Released

On 6 September, 2021, two new case studies were launched at the IUCN World Conservation Congress side event, Combining Public and Private Forces to Apply Natural Capital Accounting. The two case studies, one in India and the other in Spain, were products of a collaboration between UNSD and Holcim under the E.U.-funded Natural Capital Accounting and Valuation of Ecosystem Services (NCAVES) project. The objectives of these case studies are to assess alignment between existing private sector NCA approaches and the SEEA, explore the extent natural capital data available in statistical system can support the private sector, and identify opportunities for further alignment both in terms of concepts and methods as well as data requirements.

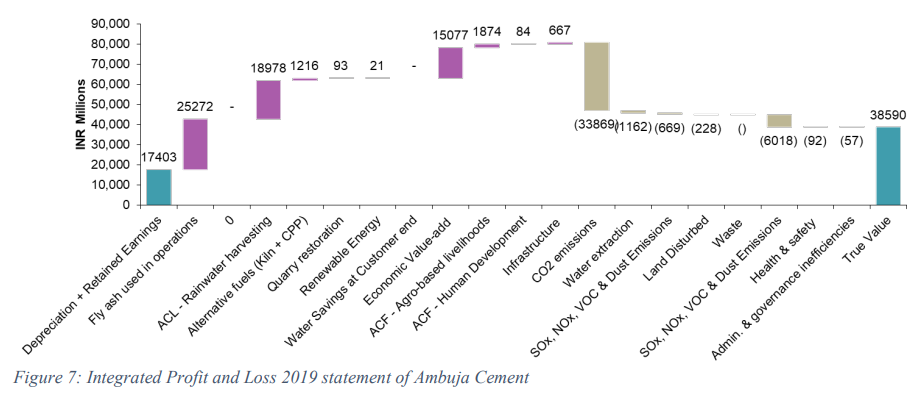

The case studies focused on a Holcim subsidiary in India and a Holcim quarry site in Spain. As described in the case studies, the overarching natural capital approach taken by Holcim is that of integrated profit and loss (IP&L) following KPMG’s “true value” methodology. IP&L functions as a tool for Holcim to understand and share with stakeholders the extent of their impacts/externalities, and to track progress against sustainability ambitions. IP&L values these impacts/externalities and integrates them with traditional financial metrics to calculate ‘true’ value/earnings (see figure below).

The case study in India took place with Ambuja Cement, headquartered in Mumbai, and one of India’s leading cement manufacturers (and a subsidiary of Holcim). This pilot case study focused on water and biodiversity for two sites. For biodiversity, Ambuja Cement uses a spatial approach using the Biodiversity Indicator and Reporting System (BIRS) which the pilot found to be well aligned with ecosystem accounting for extent and condition. With regard to water accounting, Ambuja Cement records flows in a manner generally aligned with the SEEA Central Framework, though Ambuja extends its analysis to look at the social value of water.

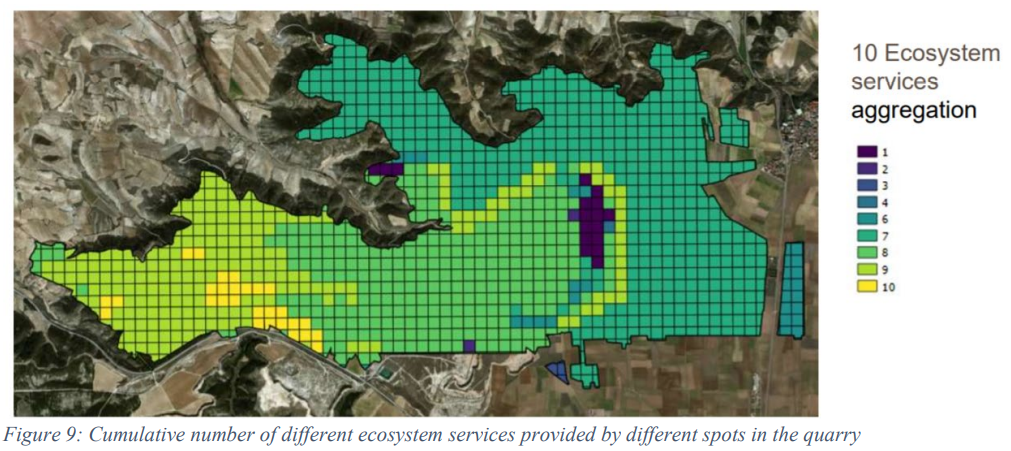

On the other hand, the case study in Spain focused on ecosystem services in the Yepes Ciruelos quarry. Holcim Spain is using a natural capital approach to measure the restoration of quarries, supported by Ecoacsa. Like Ambuja cement, Holcim Spain’s approach also shares many similarities with the SEEA, particularly the SEEA Ecosystem Accounting. In particular, Holcim Spain measures ecosystem services in physical and monetary terms. This allows to assess the social and economic benefits in different restoration scenarios. The case study also included an experimental attempt to calculate the net present value of the ecosystem services provided.

The reports also highlight the potential for greater interaction between NSOs and businesses. There was limited to no contact between NSOs and businesses in both contexts, but it was found that NSOs could provide useful benchmarking and contextual information for both Holcim Spain and Ambuja Cement. The reports also indicated that the usefulness of national-level SEEA accounts will increase as NSOs begin to offer more granular SEEA data.

Read more about the pilot case studies here:

https://seea.un.org/content/business-and-natural-capital-accounting-case-study-ambuja-cement-india